In the light of European law, the concept of

‘supply of goods’ outside of the EU1, known

as exportation, is objective in nature.

Post title

In the light of European law, the concept of ‘supply of goods’ outside of the EU[1], known as exportation, is objective in nature and it applies without regard to the purpose or results of the transactions concerned. Therefore, when the goods leave the territory of the European Union, the company is entitled to a tax rate of 0% instead of the ordinary national rate, as it is the case of domestic deliveries, even if certain formal conditions have not been met.

In the light of European law, the concept of ‘supply of goods’ outside of the EU[1], known as exportation, is objective in nature and it applies without regard to the purpose or results of the transactions concerned. Therefore, when the goods leave the territory of the European Union, the company is entitled to a tax rate of 0% instead of the ordinary national rate, as it is the case of domestic deliveries, even if certain formal conditions have not been met.

Such decision was made by the Court of Justice of the European Union (CJEU) on October 17, 2019, in a case brought by the Polish company Unitel (case number C-653/18). In fact, Unitel was required to pay a 23 percent VAT, i.e. the full rate, on the sale of mobiles telephones to a Ukrainian operator. It turned out that the company that actually bought the goods was not the one indicated on the invoice. The Polish tax authority, interpreting this fact as an attempt to fraud on both Polish and Ukrainian sides, concluded that this sale did not meet the requirements of Article 2 (8) of the Goods Tax Act regarding exports. Therefore, it required the payment of full VAT (at a rate of 23%), and thus not qualifying the operation as exportation eligible of VAT exemption. The Polish tax authority also observed that Unitel had drawn up its invoices “based on data submitted by entities whose mandates were not valid or which did not possess genuine business addresses or valid documents providing proof of VAT accounting.” The case was referred to the ECJ by the Polish Supreme Administrative Court in form of a request for a preliminary ruling.

The ECJ ruled in favour of the Polish company, stating that the exporter is not responsible for the buyer’s failure to pay VAT, if he was not aware of that fact. According to the CJEU, it would be disproportionate to hold a taxable person liable for the shortfall in tax caused by fraudulent acts of third parties over which he has no influence whatsoever (in this case, the Ukrainian contractor). However, according to the CJEU, the EU law requires an operator to act in good faith and to take every step which could reasonably be asked of him to satisfy himself that the transaction which he is carrying out does not result in his participation in tax evasion. For this reason, if it were concluded that the taxable person knew or ought to have known that the transaction was part of a fraud and has not taken every step to prevent that fraud, he would have to be refused the right to be exempted from the VAT zero-rate.

By ruling in this direction, the Court questioned the practice of the Polish tax authorities and the case law of national administrative courts. According to the ECJ, the tax authorities cannot automatically demand payment of 23% VAT, which would be equivalent to requalifying the transaction as domestic sales. According to the Court, the mere fact that goods leave the customs territory of the EU qualifies an operation of exportation and as laid down in Article 146(1)(b) of the VAT Directive, makes it eligible for the exemption.

This is an important ruling for all the exporters who need be aware that in order to retain the right to the VAT exemption they have to prove that they have exercised due diligence to ensure that lawfulness of the transaction.

In 2018, the ECJ took the same position in an intra-EU case, concerning the export of goods from Slovenia to Romania. The EU court decided, on October 25, 2018, in the case of Milan Božičevič Ježovnik (case number C-528/17) that “Automatically denying a taxable importer and supplier, without regard to his diligence, the right to the exemption from import VAT in the case of fraud committed by a customer in the context of the subsequent intra-Community supply would have the effect of breaking the link between the import exemption and the exemption of the subsequent intra-Community supply”. Therefore, analogically to the judgment of 17 October 2019, a European taxpayer may be deprived of the right to a refund or deduction of VAT only if he knew or should have known that the transaction which he was conducting was part of tax fraud or tax evasion. Consequently, the obligation of due diligence concerns not only the exporters to third countries, but also those selling products within the European Union.

Iga Kurowska

Verne Legal

i.kurowska@vernelegal.com

[1]Unlike the export of goods from the territory of Poland to the territory of another EU country which is called intra-Community supply of goods and which is also subject to a zero rate of value added tax (VAT) but based on other regulations and slightly different rules.

Verne Legal provides a customized legal and tax advisory service to both French and foreign companies. It advises clients in running their business in France, offering strategic assistance enriched by multicultural sensitivity. For more information on the tax law in France, we invite you to download “Doing business in France” e-book and to contact our team at info@vernelegal.com.

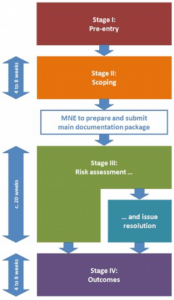

On September 16, 2019, French minister Gérald Darmanin, responsible for developing the budget and country’s transformation policy, announced that France will join eighteen other countries, including Poland, participating in the tax risk assessment program ICAP 2.0, run as part of the OECD cooperation. This program aims among others at combatting more effectively tax avoidance and tax fraud practiced by multinational corporations.

On September 16, 2019, French minister Gérald Darmanin, responsible for developing the budget and country’s transformation policy, announced that France will join eighteen other countries, including Poland, participating in the tax risk assessment program ICAP 2.0, run as part of the OECD cooperation. This program aims among others at combatting more effectively tax avoidance and tax fraud practiced by multinational corporations.