On September 16, 2019, French minister Gérald Darmanin

announced that France will join eighteen other countries

participating in the tax risk assessment program ICAP 2.0.

Post title

On September 16, 2019, French minister Gérald Darmanin, responsible for developing the budget and country’s transformation policy, announced that France will join eighteen other countries, including Poland, participating in the tax risk assessment program ICAP 2.0, run as part of the OECD cooperation. This program aims among others at combatting more effectively tax avoidance and tax fraud practiced by multinational corporations.

On September 16, 2019, French minister Gérald Darmanin, responsible for developing the budget and country’s transformation policy, announced that France will join eighteen other countries, including Poland, participating in the tax risk assessment program ICAP 2.0, run as part of the OECD cooperation. This program aims among others at combatting more effectively tax avoidance and tax fraud practiced by multinational corporations.

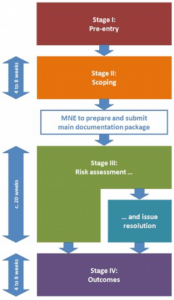

The purpose of France participation is to contribute to the improvement of France’s relations with foreign companies present on the international arena and is yet another proof of France implementing policies favoring the development of foreign trade in this country. The program consists of a series of discussions between large corporations and tax administration about tax stability and transparency. During the March meeting in Santiago, Chile, the OECD Forum no Tax Administration (FTA) decided to move to the second stage of the program – Scoping. The companies participating in the program, such as Shell International BV or Barilla, The, assess the results that have been achieved so far as very positive.

Source: OECD (2019), International Compliance Assurance Program Pilot Handbook 2.0, OECD, Paris.

Since taking up his position in 2017, Minister Darmanin has been intensively working on improving relations between taxpayers and the tax administration. He undertook to implement seven programs, including the creation of an International Tax Office whose aim would be to advise French companies developing their activities abroad on tax systems of other countries. In addition, he plans introducing simplifications for foreign companies operating in France in the tax settlement process, and the systematic publication of instructions to facilitate their understanding of this process.

A lot is being said as well about the intention of France to introduce a special tax concerning IT companies, as it has been already done in Greece, England or Italy. These changes are in line with the work of the European Union on new tax rules for e-commerce companies, which will enter into force in January 2021.

More information on the ICAP 2.0 program: OECD (2019), International Compliance Assurance Program Pilot Handbook 2.0, OECD, Paris. www.oecd.org/www.oecd.org/tax/forum-on-tax-administration/publications-and-products/international- compliance-assurance-program-pilot-handbook-2.0.htm

Iga Kurowska

Verne Legal

i.kurowska@vernelegal.com

Verne Legal provides a customized legal and tax advisory service to both French and foreign companies. It advises clients in running their business in France, offering strategic assistance enriched by multicultural sensitivity. For more information on the tax law in France, we invite you to download “Doing business in France” e-book and to contact our team at info@vernelegal.com.